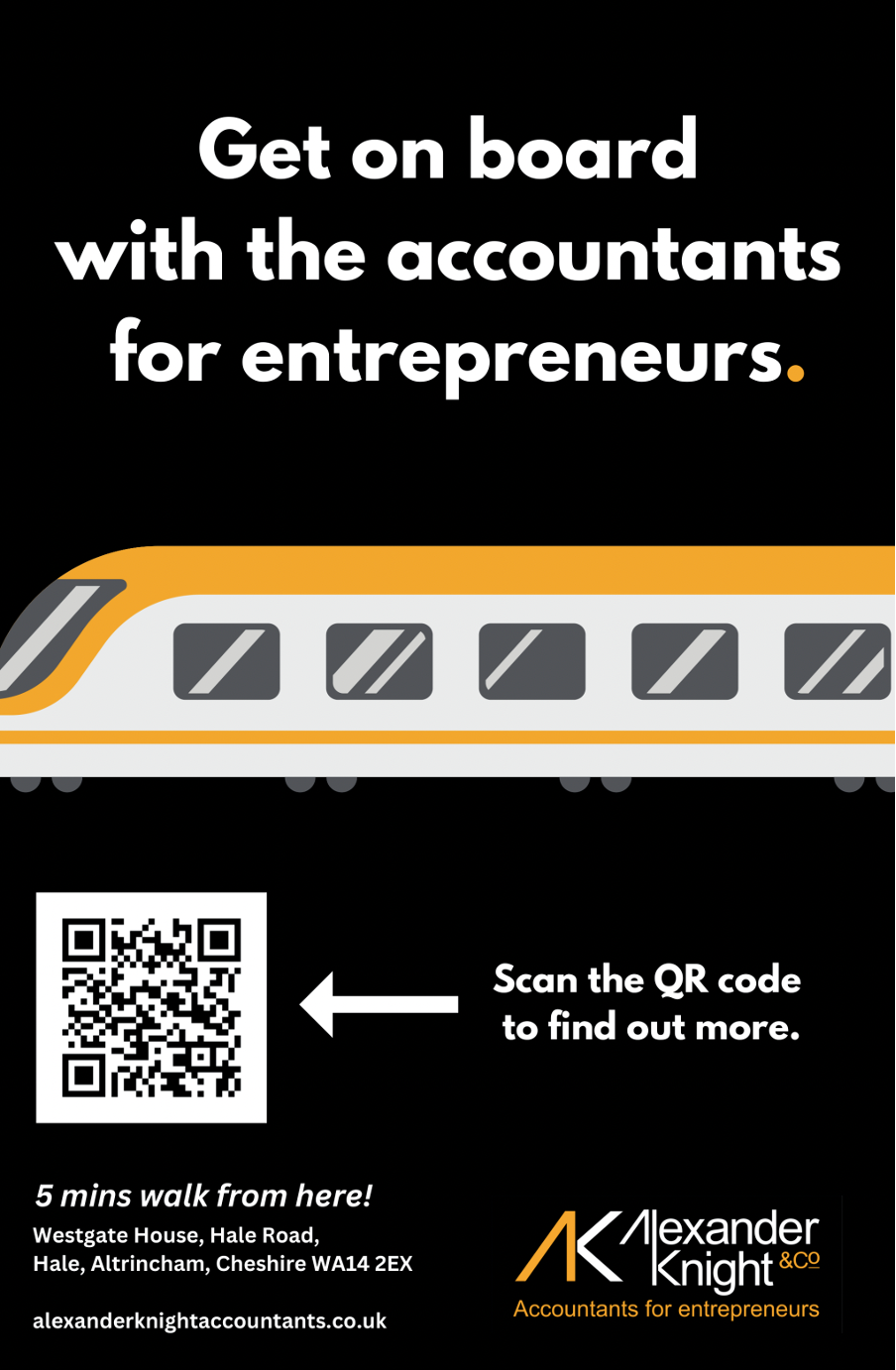

Altrincham Rail Station advert by Alexander Knight & Co accountants

Are you a commuter passing through Altrincham rail station? Keep an eye out for the latest Alexander Knight & Co advertisement proudly displayed on the information board!

We understand the importance of clear, concise information—whether it’s about your financial and business goals or your train schedule. That’s why we’ve sponsored this information board in our home town of Altrincham.

Murray Patt, founder of Alexander Knight & Co said:

“We’re proud to feature at Altrincham Rail station. We deliberately selected Platform 4 because this is the stop for the historic Mid Cheshire line which takes in Manchester, Chester, Stockport and Hale where our office is located.”

The advert at Altrincham Rail Station in 2024: